Last time, we presented the SGX data in the SpreadCharts application and briefly defined the background of asset trading in Singapore Today, we will take a better take a look at one of the most fascinating futures contract from trader’s perspective– the Rubber futures.

Before moving on, I need to clarify that there are really two rubber futures contracts traded on the SGX– the TSR 20 and RSS 3 Both are made from natural latex harvested from rubber trees Technically Specified Rubber (TSR) is liquid latex which has actually been allowed to cake normally and changed right into blocks that can be utilized in tire production. Ribbed Smoked Sheet (RSS) is liquid latex rolled into sheets and executed a smoking cigarettes procedure.

What will certainly be important for us is that TSR 20 is much more liquid contract than RSS 3, so I’ll concentrate specifically on the TSR 20 agreement from now on. Comprehensive requirements for both agreements are provided at the end of this post.

Why you must want SGX Rubber:

- Physical negotiation

- Seasonal behavior

- Little agreement size

- USD denominated

Physical settlement

Futures agreements can be resolved either monetarily or literally. Physical ways that the agreement has to be settled by the real asset upon its expiration, not just with money. Why you should respect this, if you’re simply an investor? Well, physical settlement makes certain that the contract closely tracks the cost of the underlying asset. It results in less failings in futures convergence to place costs at expiration, and the agreement is more preferred among hedgers. The reason you should care is that as a speculator, you want the futures’ cost to accurately show real conditions in the physical market. Imagine getting in a trade and stopping working to profit from it, also if the market progresses as you expected.

Nonetheless, this can be a double edged sword in some cases. Remember the unfavorable petroleum costs in springtime 2020 Well, it happened just on the WTI agreement, primarily because of its physical negotiation. By contrast, Brent futures, which are financially cleared up, did not experience negative prices during the exact same duration.

When you trade a physically settled agreement, you trade an actual product. Such agreements are rare in Southeast Asia, as physical delivery calls for extensive storage and filling facilities. That’s why most contracts are cash-settled.

Seasonal actions

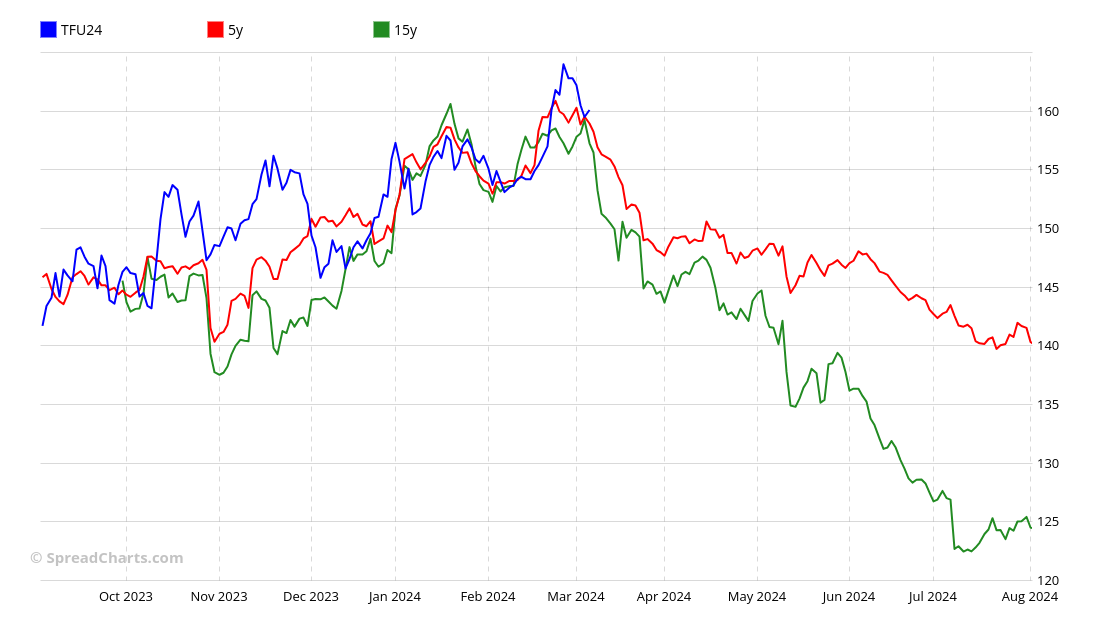

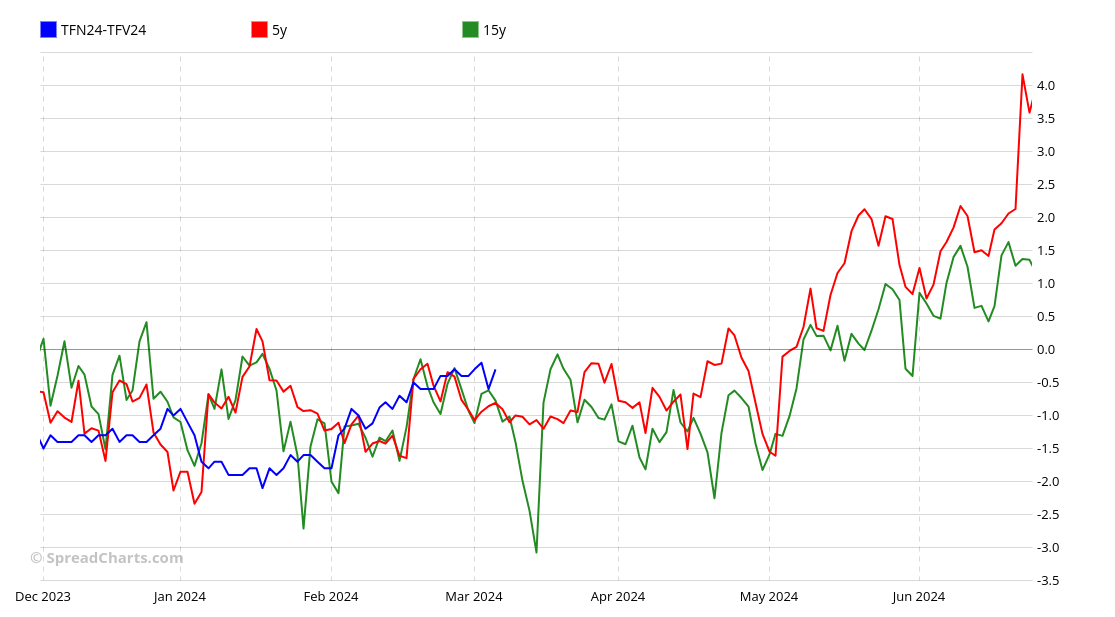

Rubber displays noteworthy seasonal fads. If you follow us for a long time, you know that we do rule out seasonality as something reliable. It does fail extremely create time to time. Nonetheless, it can work as a vital tailwind for your professions if other data is lined up with it. And rubber reveals strong seasonal patterns

As an example, a good seasonal uptrend has just wrapped up, which the rate followed rather well this year. And currently, a solid seasonal drop is beginning.

This seasonal actions appears not just in outright futures but likewise in interdelivery spreads

Small contract dimension

This is a substantial advantage for retail investors. Futures contracts often tend to be huge for historical factors. First of all, only expert investors and hedgers traded them in the 20 th century. These were normally big companies and the agreement dimension was customized for them. Additionally, trading payments were much greater before the development of digital trading and buying one large agreement was more affordable than purchasing a couple of smaller ones.

This is no more the case. Currently, smaller sized agreements are coming to be the standard, offering more versatility to hedgers and drawing in speculators that offer the much required liquidity. Even the CME Team discovered it the hard way with some specific niche products.

The SGX rubber futures agreement dimension is simply 5 statistics tonnes, converting to a point worth of only $ 50 To place this right into point of view, the months-long trading variety for this agreement stood for a simple $ 500 modification in contract worth! Normal values for some US futures contracts during an equivalent period would certainly be several thousand bucks.

Such a tiny contract dimension enables investors to use their risk monitoring without turning to excessively limited stop losses It likewise allows the trading of several contracts even by retail investors, which is required for proper money management

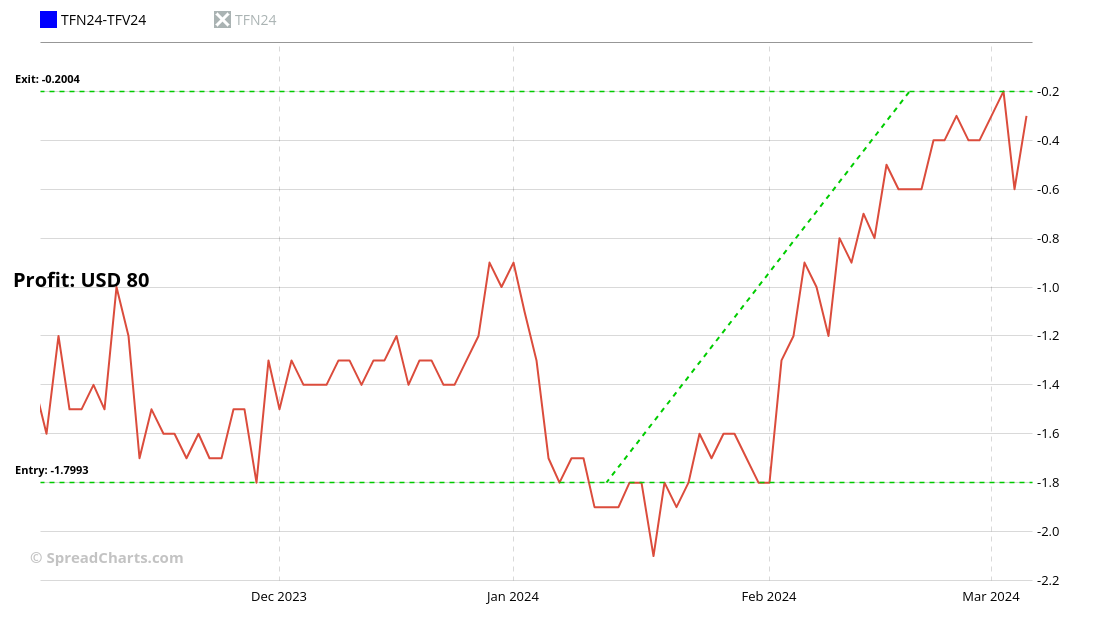

And do you bear in mind that spread on the seasonal chart a few paragraphs above? Its price adjustment over two months is worth just $ 80

USD denominated

Despite being traded on the SGX, a Singaporean exchange, the Rubber futures are denominated in US Dollars. This gets rid of currency threat for US capitalists and streamlines margin calculations. And even for traders from other countries, transforming cash to USD is normally much easier than converting to SGD.

I hope you currently comprehend why we’re so excited by adding SGX Rubber data to the SpreadCharts app. Below, we connect complete contract requirements for both the TSR 20 (artificial) and RSS 3 (natural) agreements.

We had the ability to authorize the certificate with the SGX and add this new information into the application just many thanks to our premium customers. If you intend to see extra information in the application, think about acquiring the costs subscription

|

|

|

| Contract name | SGX SICOM TSR 20 Rubber |

|

|

|

| Exchange | SGX |

|

|

|

| Ticker | TF |

|

|

|

| Expiry months | F, G, H, J, K, M, N, Q, U, V, X, Z |

|

|

|

| Currency | USD |

|

|

|

| Agreement size | 5 metric tonnes |

|

|

|

| Point value | $ 50 |

|

|

|

| Tick dimension/ value | 0. 1/ $ 5 |

|

|

|

| Settlement | Physical |

|

|

|

|

|

|

| Agreement name | SGX SICOM RSS 3 Rubber |

|

|

|

| Exchange | SGX |

|

|

|

| Ticker | RT |

|

|

|

| Expiration months | F, G, H, J, K, M, N, Q, U, V, X, Z |

|

|

|

| Money | USD |

|

|

|

| Agreement size | 5 statistics tonnes |

|

|

|

| Factor value | $ 50 |

|

|

|

| Tick dimension/ worth | 0. 1/ $ 5 |

|

|

|

| Negotiation | Physical |

|

|

|