After discussing why Rubber futures can be an excellent market for traders , we will focus on iron ore today. This is an additional important item traded on the SGX in Singapore.

Iron ore is the primary resources made use of in the manufacturing of steel. The SGX futures contract is among the world’s crucial benchmarks for iron ore offered the agreement’s specs and Singapore’s distinct strategic area in the seaborne profession Keep in mind that China represent regarding two-thirds of seaborne iron ore need, and much of it undergoes the Strait of Malacca.

Unlike rubber, which is a smaller market, iron ore is massive and far more fluid. That does not indicate it’s automatically much better. As a matter of fact, I think you’ll discover better chances in rubber as an investor. Nonetheless, it would be important to a minimum of view the rate action in iron ore if you trade commodities generally, specifically metals.

Why larger markets are more important

Did you recognize that adhering to iron ore costs can profit you greatly, also if you do not trade the iron ore futures themselves? I’m talking from my own experience. While I don’t trade iron ore, I do trade steels like silver, copper, and platinum via ETFs and (seldom) miners.

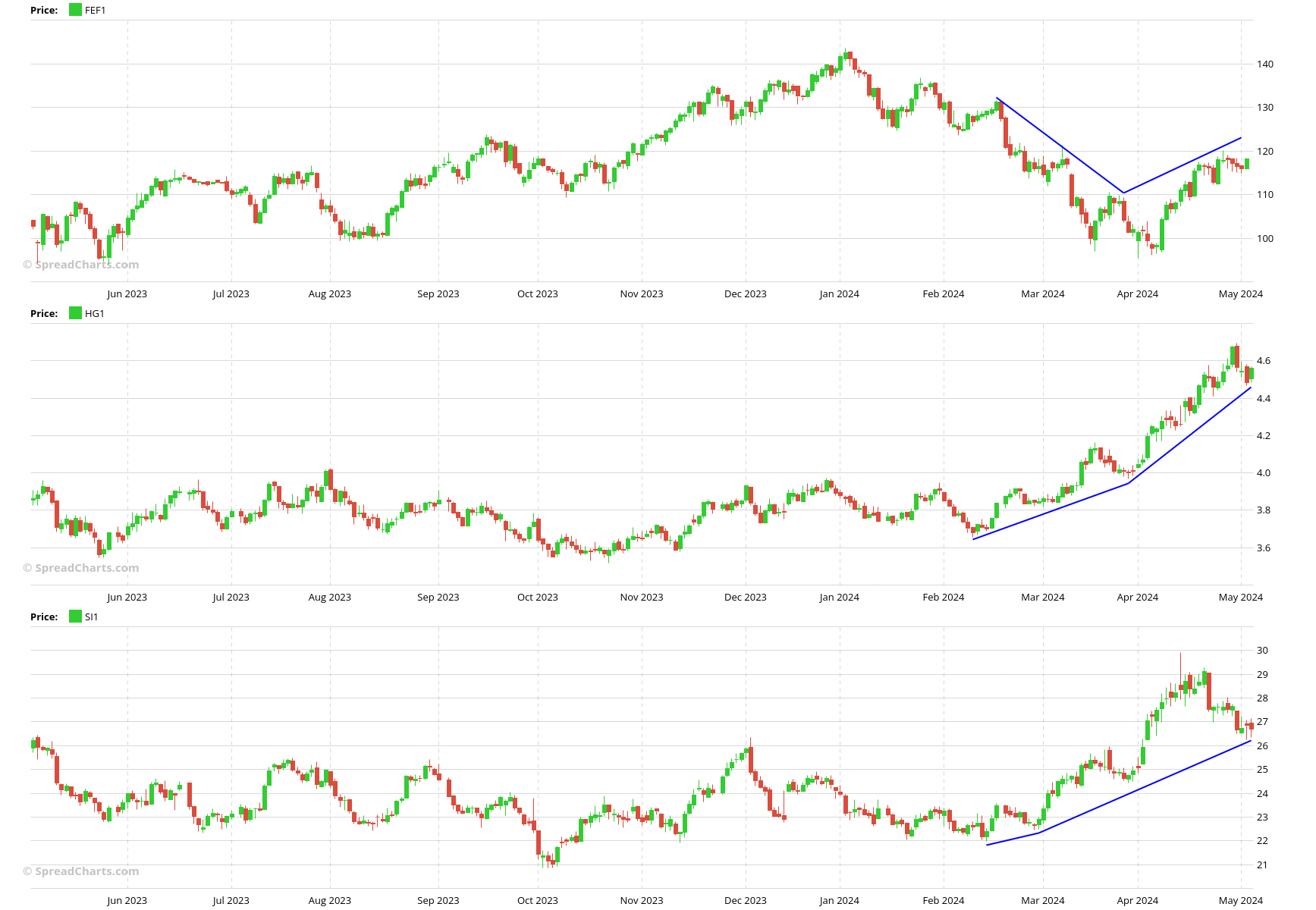

What does iron ore pertain to these different markets? First off, they are all metals and are correlated to every various other the majority of the time. And second, there is a specific pecking order within the specific commodity teams. For instance, silver is a little market contrasted to copper That means the rate swings in silver can be fairly big as it doesn’t take much cash to relocate this small market in either direction.

On the other hand, this in some cases brings about the silver rate leaving touch with the reality in the physical market. That is specifically the reason you typically see us very closely enjoying the copper market in our costs research study when making forecasts for silver. The copper market is a lot larger and for that reason more challenging to manipulate. Yes, silver can lead sometimes. However more often than not, it’s copper that’s proper if both markets differ Since in the end, metal costs rely on financial problems. And if the economic climate is weak, it’s very unlikely that a specific steel can defy gravity in spite of temporary speculative flows.

Now that you recognize the reasoning, we can relocate a step higher. While the copper market is big, the iron ore market is also larger It’s the largest asset market amongst metals. An example is better than a thousand words.

Do you bear in mind when we were unfazed by silver’s rally in spring 2023, when all the gold insects were asking for $ 30 + rates to be just nearby? Well, we saw that copper and iron ore costs did not sustain that sight.

However, markets can behave unexpectedly. The recent rally in steels is a prime example, with both silver and copper leading iron ore. Recognizing the stimulants that in fact relocate the market is helpful. Observing cross-market connections beyond just metals can be helpful in this regard, which is something we focus on heavily in our costs study.

Maintaining the above caveat in mind, I would certainly still state that bigger markets like iron ore generally dominate, considered that smaller markets like silver are extra vulnerable to being pressed by speculators. As a result, the current underperformance of iron ore must make you attentive.

Understanding right into the physical market

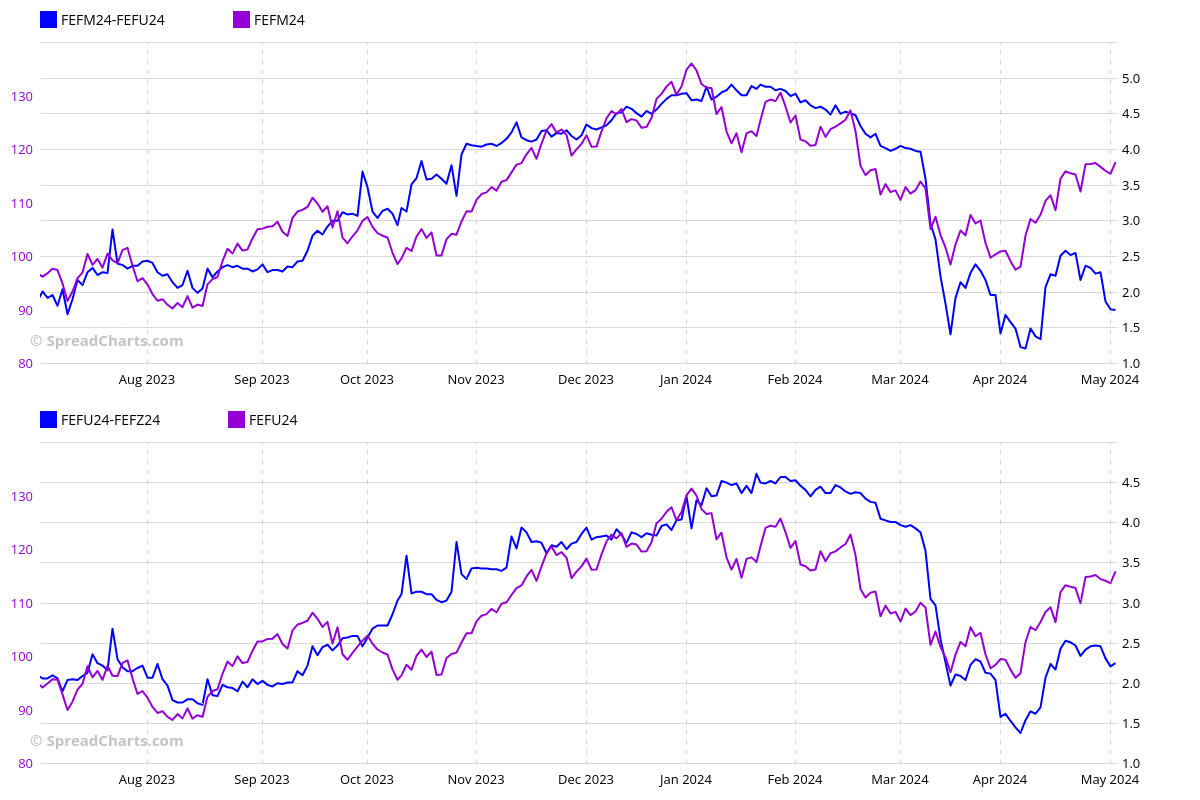

While cross-market analysis is valuable, the interdelivery spreads offer also much deeper insight right into the market. We enjoy them on a daily basis as they are possibly one of the most useful item of temporary data available. These spreads are less susceptible to broad market manipulation and better show the actual conditions in the physical market. We utilize them as verification of the trend we see in the underlying commodity.

Certainly, the very best opportunities emerge when there is a divergence between the spreads (blue) and the underlying (purple) If the aberration is maintained over a time period, the spreads are normally proper, and the underlying asset catches up. While these are short-term phenomena only and do not function 100 % of the time (like absolutely nothing in markets), it supplies an extraordinary side in product trading.

If you recognize with our premium research, you know that we carefully enjoy the copper and platinum spreads. Now you can adhere to the iron ore spreads as well as an extra piece of tremendously beneficial information. The complete contract specifications for iron ore are listed below.

We were able to sign the permit with the SGX and add this new information right into the application just thanks to our costs subscribers. If you want to see additional data in the application, take into consideration purchasing the premium subscription

|

|

|

| Agreement name | SGX TSI Iron Ore CFR China (62 % Fe Penalties) |

|

|

|

| Exchange | SGX |

|

|

|

| Ticker | FEF |

|

|

|

| Expiry months | F, G, H, J, K, M, N, Q, U, V, X, Z |

|

|

|

| Money | USD |

|

|

|

| Agreement size | 100 statistics tonnes |

|

|

|

| Factor worth | $ 100 |

|

|

|

| Tick dimension/ worth | 0. 05/ $ 5 |

|

|

|

| Settlement | Financial |

|

|

|